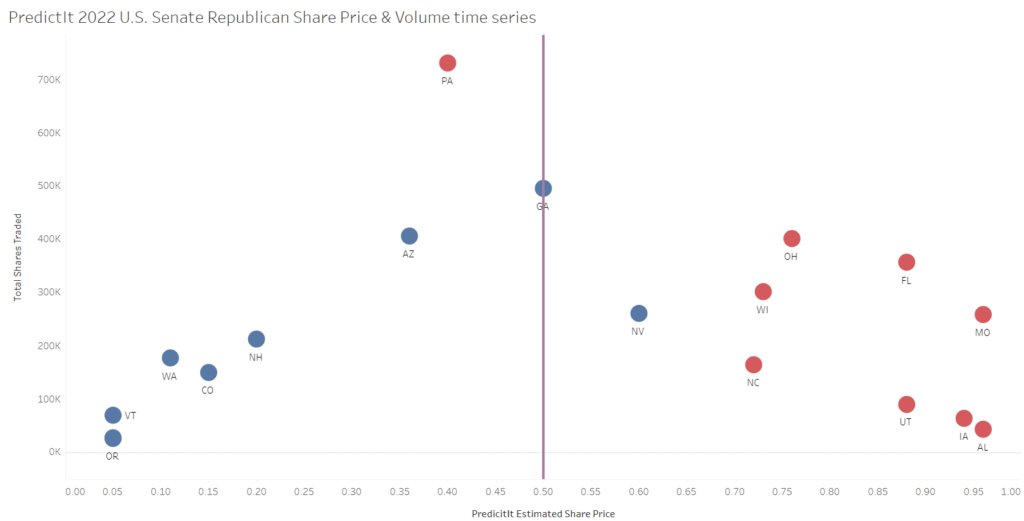

PredictIt has markets for 18 of the 2022 U.S. Senate races and if we plot over time the price of Republican contracts against total shares traded we can visualize a price-volume curve that shifts as more competitive races increase trading volume while moving toward the center ($0.50/share) of the chart.

Clicking on the below image will take you to a Tableau public chart covering June 11 – October 1, 2022:

Unsurprisingly, Pennsylvania and Georgia have the highest trading volume as of October 1st. More unexpected is the level of trading activity for Ohio, Florida, and Missouri compared to their share prices (and implied probability of victory). Florida had the highest trading on the first day plotted, June 11th, despite having an estimated share price of $0.92.

Each PredictIt contract has multiple share prices and to find an estimated price for an individual contract, the following formula was used:

(bestBuyYesCost + (1-bestBuyNoCost) + BestSellYesCost + (1- BestSellNoCost)) / 4

Both prices and total shares traded were collected daily and merged on the Contract ID number. Unfortunately, a few days of data from this timespan are missing: June 14, July 27, August 20-21, and August 30.

PredictIt is a political prediction market run by the Victoria University of Wellington, New Zealand, and Aristotle International of Washington, DC. PredictIt traders can buy “Yes” and “No” shares on whether each party (typically “Democratic” and “Republican”) will win the U.S. Senate election in a particular state. A correct prediction receives $1/share, and a wrong prediction receives $0/share. The individual share prices can indicate what traders believe is the probability of the respective party winning the election.

Recently, the Commodity Futures Trading Commission (CFTC) has withdrawn the No-Action letter (NAL) issued to Victoria University of Wellington and under which PredictIt has operated since 2014. PredictIt will be forced to shut down all markets on February 15, 2023 (100 days after the November 2022 election) but has since sued the CFTC to keep operating its remaining open markets.