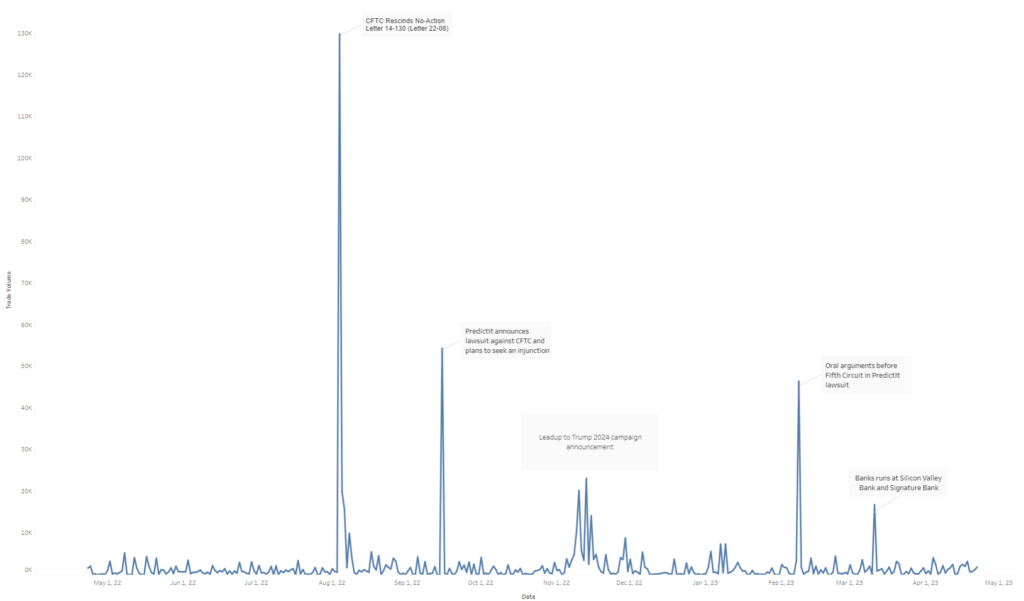

Over the past year of trading, the largest spikes in trading on PredictIt’s “Which party will win the 2024 U.S. presidential election?” market (#6867) appear to have been caused by news related to the platform itself. The CFTC initial revocation of PredictIt’s no-action letter (August 4, 2022), news of PredictIt’s lawsuit and injunction (September 15, 2022), and the oral arguments before the Fifth Circuit Court of Appeals (February 8, 2023) are the top three dates by volume.

To measure activity over time, we compared daily trade volume for the market from April 23, 2022, to April 22, 2023, aggregating the volume for each of the four contracts: Democratic, Republican, Libertarian, and Green.

Click on the chart below to examine the Tableau dashboard:

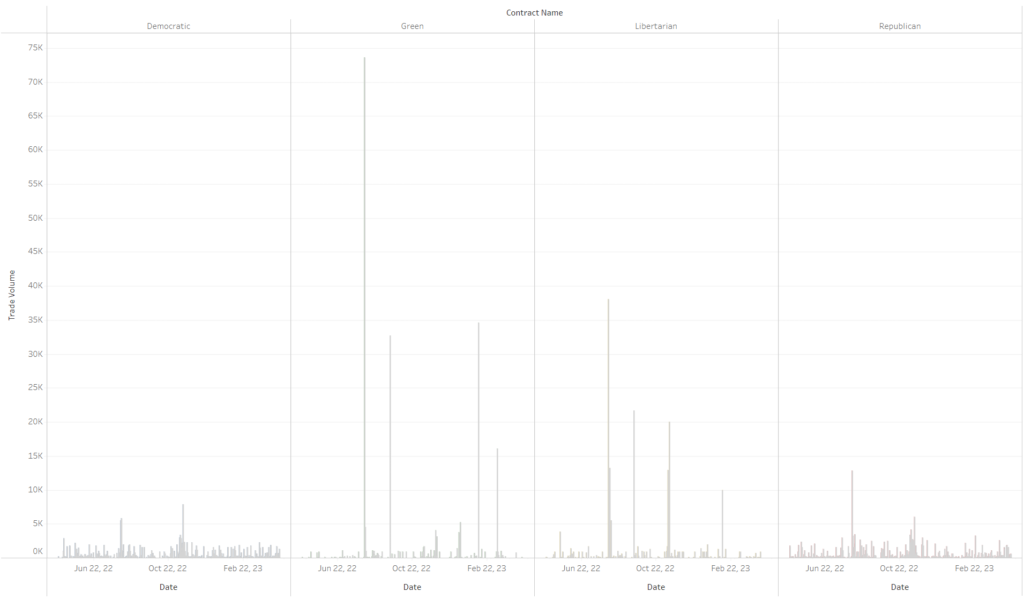

Breaking down the daily volume for the market by contract (i.e., political party), we see that Libertarian and Green contracts are driving the overwhelming majority of the trades on the five events highlighted in the chart above. (Again, click on the image to see the Tableau dashboard.)

Here is a breakdown by contract of trade volume by contract on the five top dates by activity:

| Contract Name | Date | tradeVolume | % of market |

| Democratic | 8/4/2022 | 5,537 | 4.30% |

| Green | 8/4/2022 | 73,570 | 56.60% |

| Libertarian | 8/4/2022 | 38,078 | 29.30% |

| Republican | 8/4/2022 | 12,795 | 9.80% |

| Democratic | 9/15/2022 | 57 | 0.10% |

| Green | 9/15/2022 | 32,669 | 60.00% |

| Libertarian | 9/15/2022 | 21,660 | 39.80% |

| Republican | 9/15/2022 | 32 | 0.10% |

| Democratic | 11/13/2022 | 1,525 | 6.60% |

| Green | 11/13/2022 | 0 | 0.00% |

| Libertarian | 11/13/2022 | 19,998 | 86.30% |

| Republican | 11/13/2022 | 1,659 | 7.20% |

| Democratic | 2/8/2023 | 1,709 | 3.70% |

| Green | 2/8/2023 | 34,556 | 74.30% |

| Libertarian | 2/8/2023 | 10,000 | 21.50% |

| Republican | 2/8/2023 | 245 | 0.50% |

| Democratic | 3/11/2023 | 17 | 0.10% |

| Green | 3/11/2023 | 16,059 | 95.10% |

| Libertarian | 3/11/2023 | 11 | 0.10% |

| Republican | 3/11/2023 | 793 | 4.70% |

Approximately 34% of the trading volume (270,970 out of 788,728) over the year we examined came on those five days. And on those five days, the combined percentage of trading that came from Green and Libertarian contracts ranged from 85.9% to 99.8%.

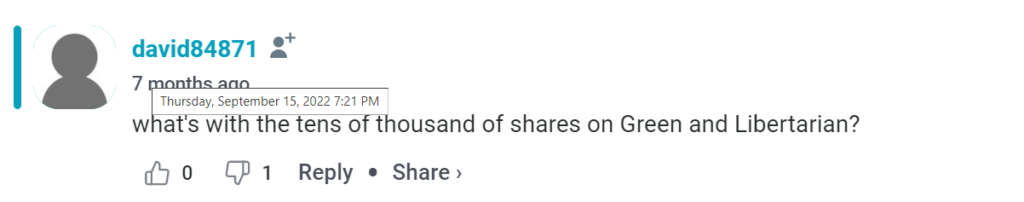

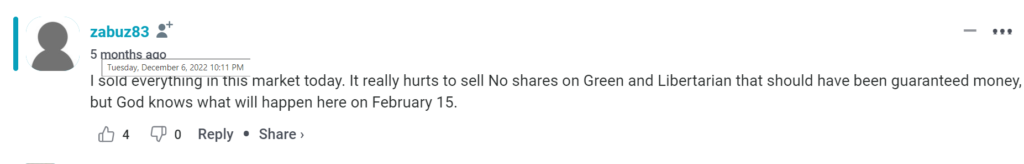

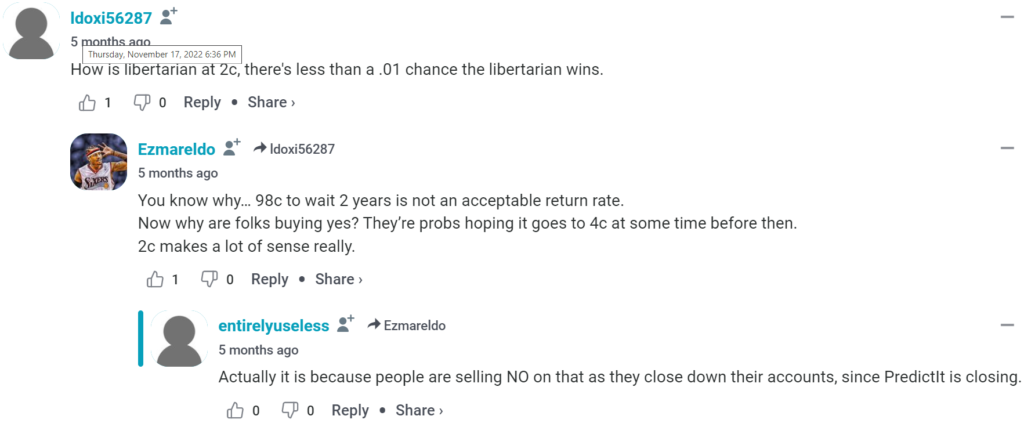

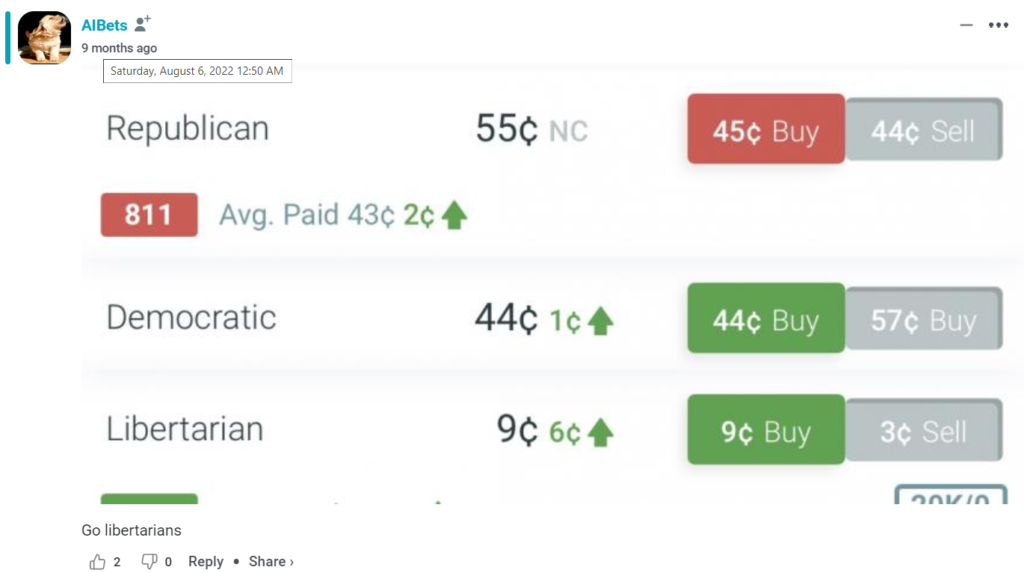

The unusual activity on PredictIt was noticeable to traders at the time:

Closing markets before the Yes/No event has been determined could get extremely complicated, as shares can trade hands many times. PredictIt has not announced how they would resolve markets prematurely, leading to uncertainty:

"We have received basically no real guidance from @PredictIt on how they intend to resolve these markets. All the while, they have been asking us to go to bat for them and advocate for them." — @pjchougule https://t.co/tJSlZ3W8QL

— Star Spangled Gamblers (@SSGamblers) March 13, 2023

And of course, there was disinformation floating around the internet:

— Talophex (@Talophex) January 22, 2023

Using tweets and market comments as anecdotal evidence, it seems possible that:

A) Traders were selling sure things (Libertarian NO and Green NO) simply because of the uncertainty of how the market would resolve:

B) Traders were more willing to bet on long shots if they thought that the CFTC’s shutdown order could force PredictIt to resolve the market in their favor – or at the very least buy back their shares.

I'm a total gambling noob but this election cycle must've been the easiest fleecing of libertarian weirdos on predictit of all time, right? I made 100 bucks without even thinking lol

— xXxT4XP4Y3RxXx401(k) (@SweetLikeGravy) November 10, 2022

Locked would have been OK. People had, and still have a lot of crazy ideas about how things will be resolved. I just kept trading like normal. Libertarian hit 5c and Green hit 4c for POTUS 2024 on the theory (I think) that they would just say 1/4 each for the 4 choices. LMAO.

— Lucy Cross (@LucyCro63776176) August 18, 2022

C) And it’s also possible that the buyers and sellers could have been operating under these two distinct, but complementary, motivations at the same time.

Looking at the Green and Libertarian contracts, there are no large price fluctuations on, or around, the days of high trading volume:

| Contract Name | Date | openSharePrice | closeSharePrice | highSharePrice | lowSharePrice | tradeVolume |

| Green | 8/3/2022 | 0.01 | 0.02 | 0.02 | 0.01 | 100 |

| Libertarian | 8/3/2022 | 0.02 | 0.03 | 0.03 | 0.02 | 100 |

| Green | 8/4/2022 | 0.02 | 0.02 | 0.04 | 0.01 | 73,570 |

| Libertarian | 8/4/2022 | 0.03 | 0.03 | 0.04 | 0.02 | 38,078 |

| Green | 8/5/2022 | 0.02 | 0.02 | 0.04 | 0.02 | 4,514 |

| Libertarian | 8/5/2022 | 0.03 | 0.03 | 0.05 | 0.03 | 6,478 |

| Green | 9/14/2022 | 0.02 | 0.02 | 0.02 | 0.02 | 0 |

| Libertarian | 9/14/2022 | 0.03 | 0.03 | 0.03 | 0.03 | 0 |

| Green | 9/15/2022 | 0.02 | 0.02 | 0.02 | 0.02 | 32,669 |

| Libertarian | 9/15/2022 | 0.03 | 0.01 | 0.03 | 0.01 | 21,660 |

| Green | 9/16/2022 | 0.02 | 0.02 | 0.02 | 0.02 | 3 |

| Libertarian | 9/16/2022 | 0.01 | 0.02 | 0.02 | 0.01 | 398 |

| Green | 2/7/2023 | 0.02 | 0.01 | 0.02 | 0.01 | 8 |

| Libertarian | 2/7/2023 | 0.01 | 0.01 | 0.01 | 0.01 | 8 |

| Green | 2/8/2023 | 0.01 | 0.01 | 0.01 | 0.01 | 34,556 |

| Libertarian | 2/8/2023 | 0.01 | 0.01 | 0.01 | 0.01 | 10,000 |

| Green | 2/9/2023 | 0.01 | 0.01 | 0.01 | 0.01 | 0 |

| Libertarian | 2/9/2023 | 0.01 | 0.01 | 0.01 | 0.01 | 0 |

| Green | 3/10/2023 | 0.01 | 0.01 | 0.01 | 0.01 | 0 |

| Libertarian | 3/10/2023 | 0.01 | 0.01 | 0.01 | 0.01 | 0 |

| Green | 3/11/2023 | 0.01 | 0.01 | 0.01 | 0.01 | 16,059 |

| Libertarian | 3/11/2023 | 0.01 | 0.02 | 0.02 | 0.01 | 11 |

| Green | 3/12/2023 | 0.01 | 0.01 | 0.01 | 0.01 | 888 |

| Libertarian | 3/12/2023 | 0.02 | 0.01 | 0.02 | 0.01 | 10 |

As always, there are some qualifications:

- Motivation is purely speculative, and different traders could have been driven to buy or sell for separate reasons.

- There is no way to know that the highlighted news events on the days in question had any connection to trading activity.

- The bank runs the week of March 11, 2023, don’t quite add up as a motivating factor because while Kalshi banked with Silicon Valley Bank and Signature Bank, PredictIt used neither institution. (PredictIt funds are kept at Eagle Bank.)

This only looks at one of the 11 markets still active on PredictIt over the 12 months. Future analysis could see if this trend holds up across all the remaining markets on PredictIt.